As a creative producer, you don’t have the time to sit and calculate the wages, taxes, and bonuses of each contractor and employee. You have to run the show–but the show can’t go on without payroll taken care of.

Fortunately, payroll management systems streamline the entire payroll process and offer support regarding laws and production insurance to keep your production safe and flowing. We’ve made a list of some of the top payroll management software to date to help you find the perfect software ahead of your next project.

What is a payroll management software?

Payroll management software is a digital solution designed to automate the payroll process for employees and contractors. This type of software simplifies the calculation of payments, taxes, deductions, and other payroll-related tasks so that employees receive their salaries accurately and on time.

Some of the most common payroll management software services include:

- Tax filing

- Payroll

- HR administration

- Time and attendance management

- Compliance

- Employer of Record

Types of payroll management software

There are a few different types of payroll management software to try.

Free Payroll Management Software

Believe it or not, there are few free payroll software options out there. However, it’s important to remember that most free payroll software caters to one person who is often a contractor or freelancer–not on the producer side of things.

Payroll Management Software for Employees

Payroll management software for employees typically refers to software that offers self-service features portals and features accessible to employees. These self-service portals allow employees to manage various aspects of their pay and benefits without going through the HR department for every concern or question.

Payroll Management Software for Small Business

Payroll management software for small businesses caters to small enterprises’ payroll needs. These software usually aim to provide all the needed to maintain documents, payments, invoices, taxes, etc., while being affordable and easy to use.

Best Payroll Management Software

Here are some of the best payroll management software you can try out for your production.

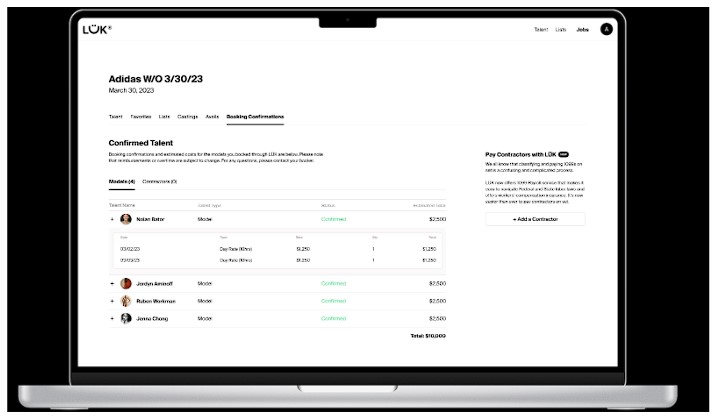

1. LÜK

LÜK is the production platform that was made to make budgeting, crew management, and payroll simple for producers. This all-in-one platform allows producers to bundle all contractor payments into one invoice, prepares and stores tax documents for tax season, and serves as an AOR (agency of record) for production so that production remains legal and compliant.

Features & Services:

- Payroll: Pay all talent with one single invoice no matter how many different freelancers and agencies you were involved with the production. Just approve and dispute one invoice for the production and LÜK takes care of the rest.

- Tax Management: Stores and sends 1099-NEC documents to independent contractors for tax season.

- AOR: Takes on the responsibility of all financial and legal procedures for contractors, Workers’ comp, and tax documentation.

- Workers’ Comp: Provide 1099 contractors Workers’ compensation for any production or project.

- Worker Classification: Correctly categorizes all employees and contractors to avoid any tax or legal troubles.

- Wage compliance by state: Make sure to pay talent and contractors in compliance with the labors of California and other states.

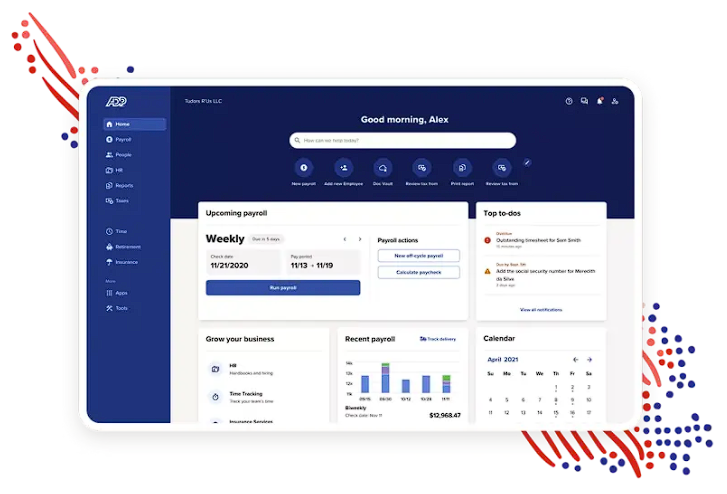

2. ADP Payroll Management

ADP is a comprehensive global solution that combines HR, payroll, talent, time, tax, and benefits administration. It provides the calculation of employee wages, withholding of taxes, and the distribution of payments via direct deposit, checks, or payroll cards.

Features & Services:

- PEO: A solution that can integrate with small and mid-sized businesses to provide HR, benefits, Workers’ comp, and more.

- Talent: Streamline recruitment and onboarding by using technology to find and screen talent best suited for roles

- Payroll: Faster payroll processing with employee and manager self-service for online and mobile apps.

- Insurance and Benefits: Offers their clients retirement plans, group health insurance, business insurance, and more.

3. Intuit Quickbooks

Intuit Quickbooks helps small businesses with HR and payroll by offering payment solutions, taxes, accounting, and time tracking solutions. This platform can automate sales tax calculations, keep records for tax season, manage bookkeeping, and more.

Features & Services:

- Manage bills: Allows users to organize, track, and pay business bills online or for partial payments.

- Calculate sales tax: Tracks tax laws and automatically calculates sales tax when added to an invoice.

- Invoice: Users can create and send custom invoices with logos and colors.

- Workforce portal: A full-service portal that allows employees to access W2s, pay stubs, etc.

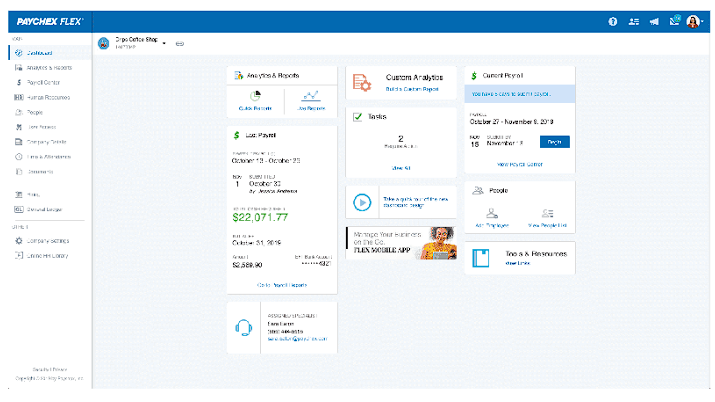

4. Paychex

Paychex provides its users with a wide range of payroll, HR, and benefits solutions. This platform’s mission is to automate tasks like payroll, employee onboarding, and insurance to save time for their clients.

Features & Services:

- Payroll: Offers payroll solutions and packages for small to large enterprises.

- Employee Health Benefit Accounts: Helps their client save money by allocating pretax funds for medical expenses,

- Time clocks: A time clock software that automates timesheet approval, reporting, and more.

- Self-employed: Helps business owners, contractors, and freelancers by offering 401k plans, tax services, and support.

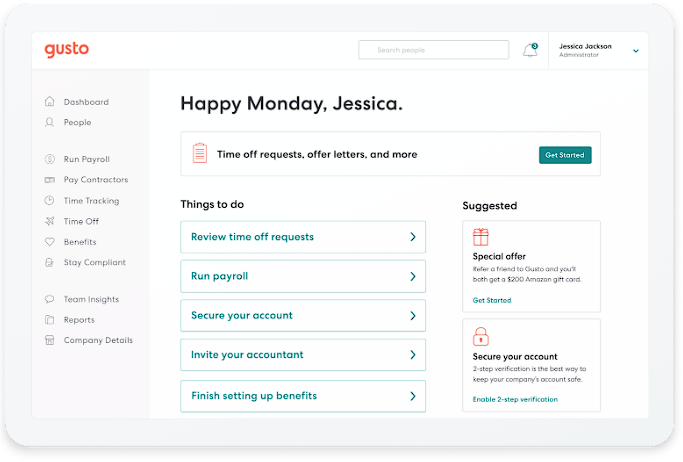

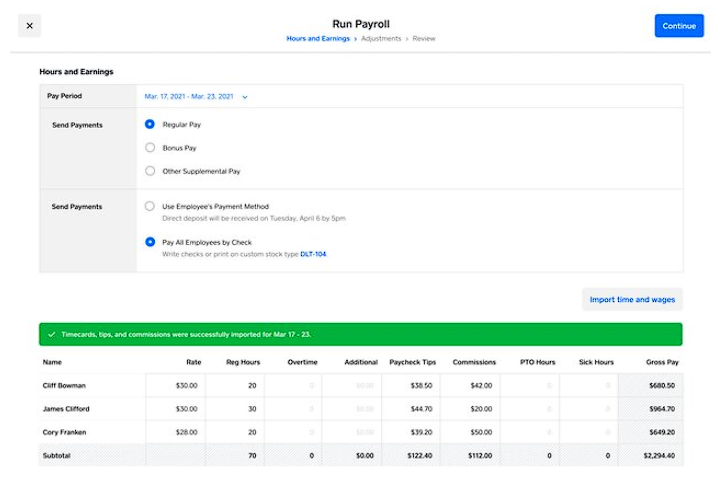

5. Gusto

Gusto software helps clients automate payroll and HR to streamline workflow and reduce errors. Clients and users can sync payroll, hire and onboard talent, get reports, and more from one place. This platform can work with clients ranging from contractors to midsized enterprises.

Features & Services:

- Insights and Reporting: Detailed insights and reporting for guidance.

- Talent management: Give feedback and promote growth with their employees.

- Hiring and onboarding: Access tools that help write offer letters, onboarding and team setup, job posts, and more.

- Tax filing: The platform can file and calculate client payroll taxes automatically.

6. Patriot Software

Patriot Software is an online accounting and payroll software that can invoice, track employee attendance, import bank transactions, and more. This platform also offers HR services that can help clients with documentation, admin tasks, and designated managers.

Features & Services:

- Accounting: Create and track custom invoices, manage receipts and documents, record payments, and more on behalf of the client.

- Payroll: Clients can access unlimited payrolls, custom hours and deductibles, contractor payroll, local and state payroll taxes, etc.

- HR Software: Clients can designate managers, assign direct reports, restrict and grant viewing for reports, store and keep employee records, and more.

Time and attendance: Clients can see time summary reports and time card history, customize their overtime rules, send employees reminders to fill out their time cards, bulk approve time cards, and more for easier attendance tracking.

7. BambooHR

Bamboo HR is a complete HR system that handles and automates all HR tasks for their clients. This system collects and gathers data for the employee life cycle, including hiring, onboarding, compensation, and more. BambooHR works best for small businesses and mid-sized enterprises.

Features & Services:

- Employee Records: Manage all employee records and data in the database.

- Reporting: Create and share reports to make data-driven decisions.

- Offboarding: Execute offboarding with checklists for compliance and automation.

- PTO: Offers an intuitive PTO tracking software that employees can use.

8. Sage

Sage is a payroll software that helps clients comply with tax laws, automates the payroll process, and offers real-time data reporting for pay rates, taxes, payments, and more. This platform HR solution, Sage HRMS, offers a paperless approach for their clients and manages benefits and employee attendance.

Features & Services:

- Inventory Planner: Clients get demanding forecasting, buying suggestions, and reporting to avoid going out of stock.

- Payroll: Track and keep records, provide business insights, stay updated on state and local laws, etc.

- Accounting: Sage 50 Accounting software fully views business finances and inventory.

- People: A cloud solution that manages employees using performance and goals data.

9. Sure Payroll

SurePayroll is a cloud-based payroll service for small and medium-sized businesses. This platform can help clients with tax filing, reporting, direct deposit setup, and more. SurePayroll also offers their clients services and tools for benefits and HR.

Features & Services:

- Benefits and HR: Provide Workers’ compensation coverage, 401k plans, health insurance plans for small businesses, and pre-employment screening.

- Payroll: Offers clients full-service or self-service options for business and contractors.

- Tax support: Stay current on all tax laws, file taxes in compliance with state laws, and take responsibility for any tax errors made.

- Time Clock: A time clock integration that reduces error and saves client time.

10.Rippling

Rippling is a workforce management platform that helps clients manage their employee’s payroll and benefits, HR, finances, and more. Rippling offers both US and global payroll services which include automated tax filing, compliance management, and reporting.

Features & Services:

- Global Payroll: Allows employers to pay their employees worldwide in their local currency.

- PEO Services: Teams can access benefits for large groups, including health plans, 401k, FSA, HSA, etc.

- Expense Management: Issue and reimburse payments and collect receipts from people in over 100 countries in any language.

- Benefits: Enroll new hires, update any tax deductions, administer COBRA, and offer health insurance packages, and more.

11. Deel

Deel is a global payroll and compliance platform that was created to help businesses hire and manage remote teams worldwide. The platform offers tools that streamline the payroll process for international employees and contractors, allowing employers to pay their global workforce in multiple currencies.

Features & Services:

- EOR: Hires and onboards employees on behalf of the client while handling documents, payroll, terminations, and PTO.

- Deel HR: A free HR platform that focuses on scaling businesses and automating basic HR tasks.

- PEO: For US teams only, clients manage their benefits, payroll and payments, HR admin, train new hires, etc.

- Global Payroll: Clients can run payroll in over 100 countries while managing visas, PTO, and expenses.

12. Papaya

Papaya is a global payroll system that manages and automates global payroll, workforce management, and compliance for organizations employing global hires. Some of Papaya’s are but not limited to global coverage, data security, and workforce analytics.

Features & Services:

- Employee Portal: Employees can access payslips, track their attendance, and request documents independently.

- Compliance: Has legal experts that help clients comply with laws in a state or country.

- EOR: Helps companies scale with the ability to hire talent from over 160 countries.

- Contractors: Clients can onboard, manage, and pay global contractors from one place.

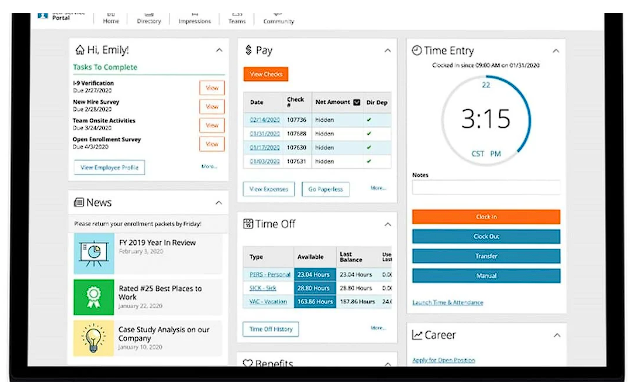

13. Paycom

Paycom offers client HR solutions for talent acquisition and management, payroll, and more. Employees can manage their PTO, paycheck, benefits, and more using the Paycom platform. Other services Paycom offers position management, onboarding, tax credits, and a report center.

Features & Services:

- HR Management: Allows clients and users to be more accurate in reporting and tracking taxes, wages, etc, to stay compliant with laws.

- Talent Acquisition: Automate the hiring process and help with staff management.

- Talent Management: Clients can manage personnel and staffing, pay employees accurately, and offer a self-service portal.

- Time and Labor Management: Automates time and labor tracking for payroll accuracy with time clocks.

14. Insperity

Insperity is an HR solution that helps with payroll, admin, and employee benefits. Some of the platform features include employment verification, payroll management, and talent management. This platform works best for small to medium-sized businesses.

Features & Services:

- Talent Management: HR professionals offering guidance and tools to find and recruit talent and train new hires.

- Risk Management: Help clients with Workers’ compensation and coverage, claim resolution, insurance, liability, termination, and all employee relations.

- HR Compliance: Provide support for compliance, job classification, drug policies, claims, and unemployment.

- Payroll: Handles all processing for payroll, including managing deductions, keeping records, onboarding, reporting, and more.

Use the Best Payroll Management Software for Productions

As a producer, you know what your project needs, down to the last detail. This goes beyond lighting and set design. You know you need reliable payroll management software to give you more time to focus on other major tasks.

Choosing the right payroll management software saves you time, prevents your production from being shut down, keeps you in compliance, provides insurance, and much more.

So…choose LÜK!

Unlike the other payroll management systems out there, LÜK was specifically designed for creative producers. The platform pays all talent and freelancers by Federal and State Labor Laws. No more worrying about issuing tax forms because LÜK automatically sends 1099 tax forms to every talent and freelancer if they meet the payment threshold set by the IRS.

Breathe easy knowing that your production is in good hands with LÜK.

![14+ Best Payroll Management Software [2024]](https://blog.luknetwork.com/wp-content/uploads/2025/03/9f416-payroll-management.png?w=1024)

![11+ Best Automated Payroll Systems & Software [2024]](https://blog.luknetwork.com/wp-content/uploads/2025/03/a589c-payroll-system.png?w=710)