When it comes to modeling agencies, IMG Models stands out as one of the most successful in the industry. Since it began in 1987, the modeling agency has launched the careers of some of the world’s most recognizable models.

LÜK is passionate about connecting the best producers with the best models (we’ve completely revamped and revitalized the casting and booking process) and that includes knowing all about the best modeling agencies in the business.

Let’s get started with this review of IMG Models and why they’re one of the most respected in the business.

Who Founded IMG Models?

IMG Models is a branch of IMG, or International Management Group. McCormick founded IMG in 1960 with the goal of seeing more athletes appear on television and receiving prominent endorsements.

McCormick believed that models could be managed the same way as professional athletes, actors, and other entertainers. Their personality could be used to build strong personal brands–beyond magazine pages and fashion shows. However, it wasn’t until Ivan Bart became the creative director in 1994 that IMG Models took off.

Ivan Bart began incorporating more inclusivity and had passion for more progressive movements. Bart was credited with pioneering the use of unique faces and bodies in fashion shows, catalogs, editorials, and more. Supermodels Tyra Bank, Joan Smalls, Gisele Bündchen, and others got their start working with Bart as he helped foster their careers to magazine covers and runways. Bart served as president of IMG Models for ten years and retired from the position in early 2023.

McCormick continued to focus on sports marketing for athletes and would go on to revolutionize advertising for athletes. Athletes can now take on movie roles, endorse brands, model for fashion brands and magazines because of his efforts. Some notable famous athletes that McCormick represented are Arnold Palmers, Derek Jeter, Tiger Woods, and Monica Seles.

Ready to Streamline Your Casting, Booking, and Payroll Process?

IMG Models Review

IMG Models is an industry leader in talent discovery and model management, pushing boundaries with their clients and expanding opportunities for their talent. With a management team that’s been together for almost 30 years, IMG stands out from the rest as a stable and reliable source of support.

IMG does not discriminate based on race, age, or size and has even created the Model Prep program to promote the advocate for the health and safety of young models. They are also working on a more comprehensive, year-round program to help further this goal.

It also reopened their Men’s department, which was shut down in 2007.

Notable IMG Models

Some of the most recognized faces from IMG Models are:

- Tyra Banks

- Karlie Kloss

- Lily Aldridge

- Niki Taylor

- Gisele Bündchen

- Kate Moss

- Carolyn Murphy

- Alessandra Ambrosio

- Ashley Graham

- Lameka Fox

- Chanel Iman

- Thylane Blondeau

- Gigi Hadid

- Bella Hadid

IMG Model Locations

New York

IMG Models New York represents some of the most prominent faces, talent, and supermodels in fashion today like Heidi Klum, Liya Kebede, Shalom Harlow, Jordan Dunn, Ciara, and Maddie Ziegler.

IMG New York has also provided talent for editorial shoots with Vogue, Elle Magazine, Harper’s Bazaar, Pepsi Commercials, and more. They are also the official organizer and operator for New York Fashion Week, held in February and September every year.

Los Angeles

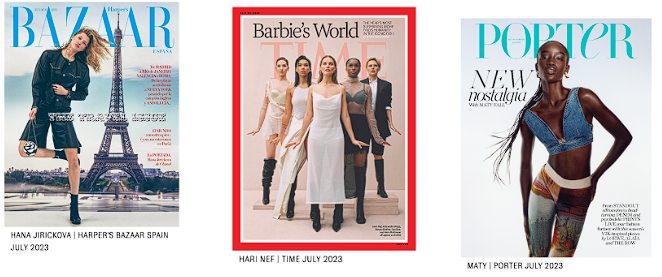

Famous faces that are signed to IMG Models Los Angeles include household names like Hailey Bieber, Ashley Graham, Bella and Gigi Hadid, Miranda Kerr, Jessica Stam, and Joan Smalls. Along with talent Wisdom Kaye, Natalia Bryant, and Hari Nef.

IMG Model Los Angeles has collaborated with InStyle, WSJ, The September Issues, Pop, and Perfect Magazine.

Paris

IMG Models Paris is known to represent Simon Nessman, Alton Masson, Soo Joo Park, Ahmed Richards, Fabio Rosario, Thylane Blondeau, and more. IMG Models Paris regularly work with Vogue Paris and Elle for editorials, and their models have been prominent figures on the Paris Fashion Week runways for years.

London

IMG Models London boasts talent and models Amanda Wellsh, Bambi, Chanel Iman, Camila Monroe, Claire Collins, Gemma Ward, and Charlee Fraser. And the London-based office has worked with famous publications including Document Magazine, Muse, Love Want, Porter Edit, Imprint, and GQ.

Milan

Their Milan location features top models Elizabeth Lake, Ellie Thumann, Emily Didonato, Hannah Ferguson, Lily Nova, Ben Corbett, and Amergio Valenti. IMG Milan has talent that walk for the Milan Fashion Week, and regularly works with Vogue Italia, Dust, Esquire, Antidote, Amica, and more.

IMG has recently opened their own Men’s division in 2018, signing over 100 male models.

Sydney

IMG Models Sydney is home for models and talent Albert Reed, Aleksander Rusic, Chad Hurts, Bom Chan Lee, Gabriel-Kane Day-Lewis, Abby Bush, Anissa, Grace Monfries, Noel Berry and Nicole Trunfio. Their talent has worked with Giorgio Armani, Numero, Re-edition, Favorite, Dior, Madame Figaro, Vogue Brides, and InStyle.

Casting, Booking, and Production Payroll Has Never Been Easier

IMG Model Resources

IMG Website

IMG Social Media

More About IMG Models

How much does IMG pay their models?

An IMG model’s salary depends on their skills, experience, fame, location, and the specific project the model is working on. According to ZipRecruiter, the salary for IMG models in New York can range from an estimated $11,868 to $216,316 with an average annual income of $77,645.

It’s important to note that some agency fees associated with comp cards and portfolio development can be withheld from a model’s earnings.

What are the requirements to become an IMG model?

IMG Models does have a height requirement for their models. Women should stand at least 5’9, and men should be taller than 6’1. The median age of models and talent that IMG signs is between 16 to 21 years of age, but they also work with older talent.

Does IMG Models accept applications or submissions?

You can submit your portfolio to IMG Models or contact them directly through their social media platforms and website. IMG Models does not ask any newcomers for interviews, request explicit photos, or any monetary payment.

Final Thoughts on IMG Models

For over thirty years, IMG Models has established its reputation as one of the premier agencies for models, representing some of the biggest names in the industry. IMG Models works hard to find fresh faces and unique talent to represent their agency and set new standards in the entertainment industry.

If you’re looking to connect with top talent to feature in your next project, it’s time for you to work with LÜK. Our collection of producer tools make the casting, booking, and contractor payroll process simple and seamless.

Our platform connects talent from multiple agencies with major brands and production companies worldwide. We even give every client their own personal booking specialist who will oversee the entire process from start to finish, including castings, checking availability, and asking for digital/polaroid images.

And our 1099 payroll feature makes it simpler than ever to pay talent. All 1099 contractors can be combined into a single invoice, and the payments are handled for you. You don’t have to stress about payroll taxes, tracking tax records, or subtracting taxes from employee wages.

Join the other top producers that are already using LÜK to simplify their life.

![Contractor Payments: All the Ways to Pay Independent Contractors [2023]](https://blog.luknetwork.com/wp-content/uploads/2025/03/4ca8d-luk-talent.png?w=838)