In the exciting world of production, managing payroll for below the line (BTL) crew members is a critical task for producers. From camera operators to sound technicians, production assistants to set designers, BTL employees play a crucial role in bringing a production to life. But we get it: navigating BTL payroll and optimizing costs can be a challenge!

Whether you’re a producer, production manager, or someone interested in understanding the intricacies of BTL payroll, we created this comprehensive guide to be your resource so you can keep your productions running smoothly.

From negotiating rates to managing employee vs independent contractor payments, we’ll break down everything you need to know to successfully manage below the line payroll in the entertainment industry.

What is BTL Payroll?

“Below the Line” is used in the entertainment industry and production accounting to refer to production costs that are separate from the main budget. It’s basically everything that’s not directly related to the creative aspects or top-billed talent.

BTL workers are the technical crew members who don’t provide creative input or lead the project. They also include actors who have smaller roles, rather than those who get top billing.

These folks are often well-versed in the industry’s working conditions, protocols, and requirements. Their familiarity with production processes and standards enables them to seamlessly integrate into new projects.

Above-the-Line vs Below-the-Line

While BTL payroll includes payments for technical crew and non-key cast members, “above the line” payroll refers to payments for creative talent and the main production members who have more pivotal roles in the work at hand. These folks are usually contracted separately from the rest of the crew because they’re the ones calling the shots.

The Importance of Effective BTL Payroll Management

Optimizes Costs

Since BTL workers are typically hired on an as-needed basis, your production can scale its workforce based on the project’s requirements. This flexibility helps avoid overstaffing and allows for cost savings by minimizing team expenses during slower periods.

You’re also empowered to leverage a streamlined 1099 payroll process. Efficient payroll administration processes, achieved through payroll software or services, can reduce manual errors, save time, and minimize administrative costs.

It’s Easier to Correct Payroll Mistakes

BTL payment is often based on standard pay rates or hourly wages, without complex compensation structures like profit-sharing or residuals like their ATL counterparts. The simplified nature of BTL payroll can make it easier to spot and correct errors as there are fewer complexities involved.

However, if you’re manually managing BTL payments, it can get complicated–quick. Without a centralized system it can be easier to make mistakes…and then harder to catch and correct them. A contractor payroll software that manages invoices, correctly identifies employees vs independent contractors, and tracks documentation makes it much easier to remedy any payroll errors.

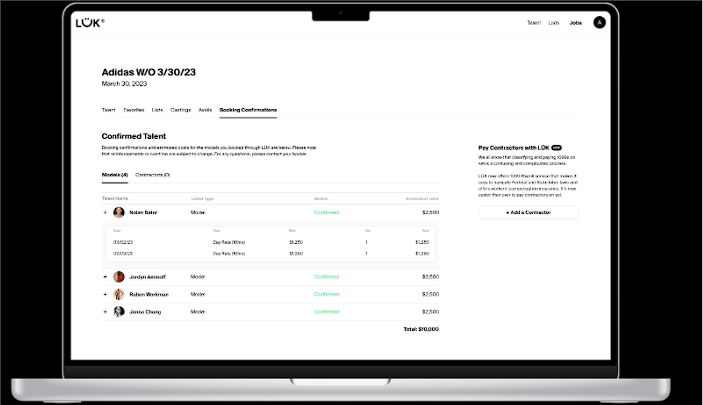

LÜK Network’s 1099 payroll management system streamlines payroll for all sorts of productions. With LÜK Pay, producers can pay a single consolidated invoice to freelancers and vendors, regardless of how many different agencies or freelancers they’ve hired.

Plus, LÜK takes on the responsibility of paying talent as contractors in accordance with labor laws, including in California and all other states in the US. This feature ensures labor compliance and can replace traditional W9 payment processors.

Speeds Up Hiring

It’s typical for production companies to work with the same crew members on a variety of gigs that may require distinct payrolls and processes to match. By payroll service, the rehiring rigamarole becomes significantly more efficient or sidestepped entirely for the duration of use.

BTL payroll solutions offer comprehensive data management, per talent/per gig, which efficiently eliminates repetitive tasks. With an integrated crew list database that’s customizable for each company production teams are empowered to rehire/pay crew members with a simple click. In this way, services such as LÜK Pay optimize the payroll process and bring a new level of ease to the fast-paced world of commercial production.

How to Manage Below-the-Line Payroll for Reduced Costs

1. Use Payroll Management Software

Using entertainment payroll software is one of the best ways to make BTL payroll manageable. With the right BTL payroll software, producers can experience:

- Streamlined Processes: Entertainment payroll software automates time-consuming tasks, such as calculating wages, withholding taxes, and generating pay stubs. This streamlines payroll administration, saving significant time and effort for production teams.

- Compliance and Accuracy: These platforms are designed to stay up-to-date with changing labor laws, tax regulations, and industry-specific requirements. By using such software, production companies can ensure compliance and accurate calculations, reducing the risk of costly errors or penalties.

- Efficient Payout: With the ability to set up direct deposits, generate electronic paychecks, and manage multiple payment methods, production companies can provide convenient and secure payment options for their workforce. Better still, talent feel empowered to receive their pay in a timely, efficient way.

- Enhanced Transparency and Accessibility: Payroll software often provides self-service portals for employees, allowing them to access their payment details, tax forms, and other relevant documents. This transparency promotes employee satisfaction and reduces administrative burdens by giving crew members direct access to their payroll information.

What is the best software for BTL payroll support? LÜK. LÜK’s contractor payment solution accurately categorizes freelancers, takes care of employee compensation and payroll taxes, and pays talent from various modeling and casting agencies with just one invoice.

Producers access comprehensive, thorough payout management and contractors get streamlined, transparent access to their compensation.

2. Negotiate Rates

When negotiating rates for the BTL team, it’s essential to research and know your industry’s standards and benchmarks to ensure fair pay for their skills and expertise. You should:

- Take into consideration factors such as the complexity of the project, the level of experience required, and the market demand for specific roles when determining suitable rates

- Clearly communicate your budget constraints and expectations to the BTL team members, fostering an open dialogue that allows for mutual understanding and negotiation.

Negotiating rates isn’t only about reaching the best possible deal but also about building positive and long-lasting relationships with the BTL team. A collaborative and respectful approach can lead to successful rate negotiations and cultivate a productive working environment for future projects to come.

3. Offer a Realistic Schedule

When creating a schedule for the BTL crew, it’s crucial to consider a project’s scope and complexity, and the resources available to determine a realistic timeline for your deliverables. You’ll want to be sure to collaborate with the BTL crew members to understand their expertise, availability, and any potential constraints that may impact their ability to meet certain deadlines.

It’s also helpful to allow for buffer time in the schedule to account for unexpected delays, technical challenges, or adjustments that may arise during production.

Make sure to maintain open lines of communication with the BTL crew throughout the project, regularly update them on any schedule changes, and proactively address any concerns or conflicts that may arise to ensure a smooth and realistic flow as you complete your project.

4. Hire Local Cast & Crew Members

Local cast and crew members can leverage their knowledge of the area and familiarity with local resources, as well as provide potential cost savings on travel and accommodation expenses. This can also contribute to sustainability efforts by reducing the carbon footprint associated with long-distance travel and transportation, aligning with eco-conscious production practices.

Engaging local talent also fosters community involvement and support, creating a positive impact on the local economy and building strong relationships within the industry. Furthermore, local cast and crew members often have established networks and connections within your project’s location making it easier to access additional resources, locations, or specialized services at more affordable rates.

5. Understand Employees vs Independent Contractor

Understanding the distinction between employee classification and independent contractor status is crucial for compliance with labor laws and tax regulations. Key considerations include the level of control and independence in the working relationship, the nature of the tasks performed, and the financial arrangements involved. Clearly, this requires a great deal of time and effort to ensure you’re working within the letter of the law.

With a payroll service like the one offered by LÜK, the tedium of classification can be entirely lifted from your workflow by outsourcing it to the pros. LÜK Network’s payroll pros automatically classify your hired talent, providing a 40% reduction of payroll expenses–and an innumerable amount of effort. By correctly classifying workers as 1099 independent contractors, employers don’t have to pay additional federal and state payroll taxes (Social Security, Medicare, and Federal & State Unemployment can range from 12% to 15% of the total payroll).

Additionally, the stored database of talent info enables you to track who is who and how to classify them as you bring them aboard your production.

6. Integrate Onboarding With Payroll

Integrating onboarding with payroll for BTL crew members can be achieved by streamlining the administrative processes. This can include ensuring that necessary employee information, such as tax forms and direct deposit details, is collected during the onboarding phase.

Additionally, integrating the onboarding system with payroll software or services can automate the transfer of employee data, simplifying the payroll setup and ensuring a smooth transition from onboarding to timely and accurate payroll processing.

The Best Way to Manage BTL Payroll

All in all, BTL payroll encompasses the process of managing and executing payroll functions for a given production. It involves all of the steps therein, ensuring timely, accurate payment distribution and a comprehensive database of all relevant info at hand.

Investing in reliable payroll software or services designed for production will greatly streamline your BTL payroll management. Tools like LÜK empower producers with comprehensive, thorough payout management for all cast and crew–and provide talent with streamlined, transparent access to their compensation.

But yes, we’re partial, because we have full confidence that our team is rearing and ready to take on your project. We’d love to begin the journey as your Production Partner and Payroll Hero.

![Ultimate BTL Payroll Guide: What It Is & Best Practices [2023]](https://blog.luknetwork.com/wp-content/uploads/2025/03/9edf6-btl-payroll-guide.png?w=468)

![11+ Best Production Payroll Companies [2023]](https://blog.luknetwork.com/wp-content/uploads/2025/03/bdeb4-proudction-payroll.png?w=702)