The best way to stay organized in the busy world of entertainment is with an automated payroll system. You have a show to run–you don’t have time to field millions of invoice emails and calculate wages.

The right production payroll system can help streamline operations, reduce errors, and save valuable time and resources that can be better invested elsewhere.

This article will cover an extensive list of some of the best automated payroll software to consider so you can say goodbye to antiquated payroll systems and hello to efficiency, organization, and more time for creativity.

What is automated payroll?

Automated payroll is a digital system that manages, organizes, and simplifies the overall payroll process. It can be a software or tool that keeps track of all financial records and documents for tax purposes and takes care of workers’ compensation, salaries, deductions, and more.

For a producer managing a major project, implementing a great automated payroll system can help you save time, avoid errors, and comply with local and national state and labor laws.

Automated Payroll Systems Benefits

Automated payroll systems have revolutionized how businesses manage and execute their payroll processes. They handle every aspect of payroll management, from calculating payments and taxes to distributing employee wages and maintaining financial records–so you don’t have to.

If we listed every benefit that comes with using an automated payroll system we’d all be here all day! So let’s do a quick recap of the important ones:

- Saves Time: Automated payroll systems streamline the entertainment payroll process by quickly performing calculations that would otherwise take up all your time. Using a payroll system frees up time to focus on other important tasks within the production.

- Compliance: Automated payroll systems are regularly updated to comply with tax laws and labor regulations for states and other territories. This helps your production avoid any costly penalties associated with non-compliance.

- Accuracy: Manual payroll processing is bound for error–we’re human, after all! Automated payroll systems are designed to compute payments accurately, accounting for variables such as overtime, taxes, and benefits deductions, with minimal errors.

- Scalability: Automated systems can scale up to accommodate an increasing number of employees without any issues.

- Avoid Legal Risks: Employing an automated payroll system can also help you avoid any legal penalties and fees. Most payroll systems will handle taxes, bookkeeping, and classify workers correctly. If any of these tasks were done incorrectly, it could lead to serious issues for your production.

Features to Look For In Automated Payroll Systems

Choosing your automated payroll system should depend on what your production needs. Take some time to consider everything that will be used during your production.

Here are all the features that you need to have when searching for an automated payroll system:

- Tax management: Your software should make it easy (or at least easier) to manage the complexity of taxes! This includes correctly classifying employees and contractors, keeping tax records for tax season, calculating wages and deductions, and giving contractors and employees all the documents needed to file taxes.

- Workers’ comp: Your software needs to provide your 1099 workers with their Workers’ comp so that they have medical coverage in case of injury. If someone is injured on your set, you’ll be held responsible. Having workers’ comp prevents you from being sued, fined, or worse.

- Compliance: Compliance is making sure that your product is with the legal and labor of the state you’re filming in. Without compliance, you put yourself and your production at risk of being shut down or sued. If convicted, you will have to pay out of pocket for penalties and fees or serve time in federal prison.

- EOR: Having an employer of record lets producers hire talent without having a physical entity or headquarters. On top of that, producers can manage documents for taxes, find and recruit talent, send payments, and comply with all local and state labor laws.

Finally, make sure that your payroll system is easy to use and intuitive. You want to be able to get up and running quickly–not spend months on training, onboarding, and configuring.

Best Automated Payroll Systems & Software

Here’s our list of automated payroll systems that can help you streamline your payroll.

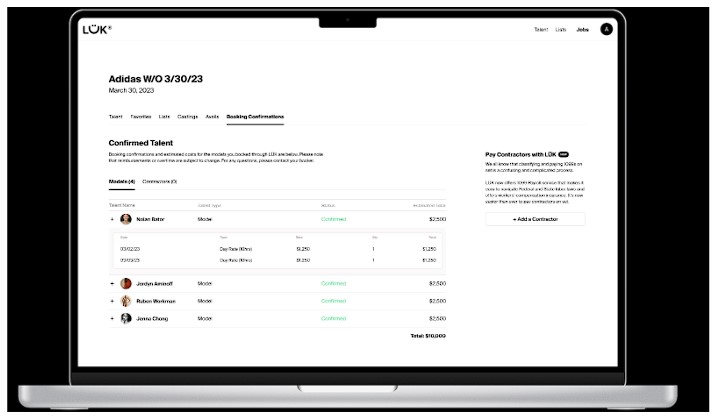

1. LUK

LÜK offers payroll management services for the heavy demands of the entertainment industry. The platform handles everything from providing workers’ comp for independent contractors and crew to ensuring that cast and crew are paid correctly and on time. It also oversees invoicing, payments, and compliance with payroll tax requirements and laws.

But that’s not all!

LÜK is an end-to-end production platform that also includes integrated budgeting, scheduling and crew management tools in addition to payroll and workers’ comp.

Finally: easy, efficient, and compliant production management.

Features & Services:

- Invoice Bundling: Bundle all 1099 payments for bookings, freelancers, and more into one invoice to reduce paperwork.

- Tax management: Automatically sends 1099-NEC to independent contractors exceeding the threshold set by the IRS for the upcoming tax season.

- Payroll management: Producers receive one invoice while payments are sent to 1099 contractors despite all talent from different agencies. This feature also takes care of talent agencies and talent payouts.

- Entertainment payroll processing: Talent and contractors are paid following federal and state labor laws, and clients can access payout confirmations and reports.

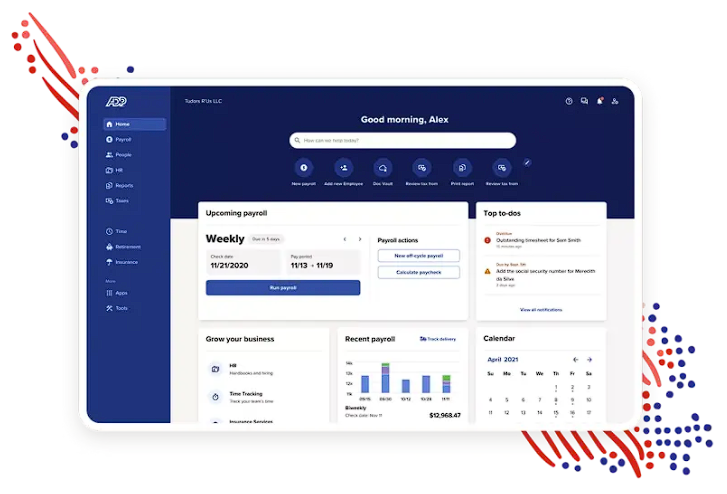

2. ADP

ADP is a payroll solution that merges human resources, payroll processing, talent acquisition, time tracking, taxation, and benefits management. ADP provides both local and global solutions and is a better fit for larger organizations.

Features & Services:

- HR Services: 24/7 customer service to help users with their payroll, taxes, compliance, HR forms, and more.

- Contract Management: Takes care of onboarding, contractor pay, and compliance with all laws and requirements as an independent contractor.

- Talent Management: Helps with talent management through recruitment, onboarding, training, compensation, termination, etc.

- Insurance: Offers group health insurance, business insurance, Workers’ compensation, and more for teams and freelancers.

Pricing: No pricing information is provided online.

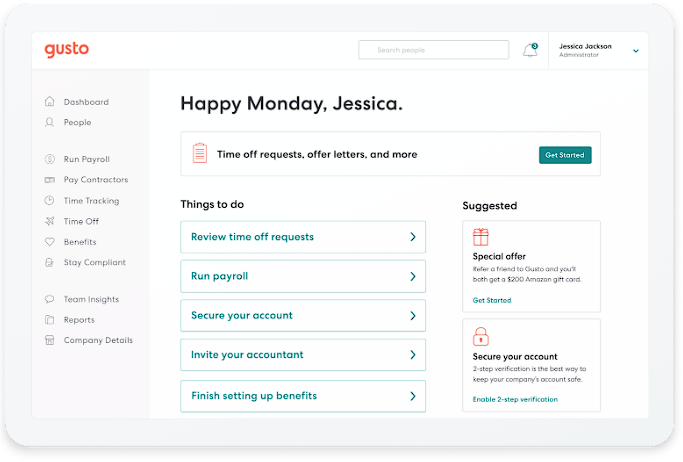

3. Gusto

Gusto is a software solution designed to simplify payroll, human resources, and administrative tasks. The platform enables clients to sync payroll, automate talent recruitment, expedite employee onboarding, and manage taxes at year-end.

This software works best for independent contractors as well as medium-sized businesses.

Features & Services:

- Hiring and Onboarding: Post public job offers, create custom onboarding checklists, and integrate with applicant tracking software.

- Workers’ Comp: Covers medical expenses and wage replacement for injuries and protects employers from legal liability

- Employee Benefits: Allows employers to offer their team benefits like health insurance, retirement plans, etc.

- Talent Management: Provide teams with tools to view and provide feedback for talent performance and development.

- Simple: $40 per month, or $6 per month, per person

- Plus: $80 per month, or $12 per month, per person

- Premium: Teams must contact Gusto for more details about the Premium plan.

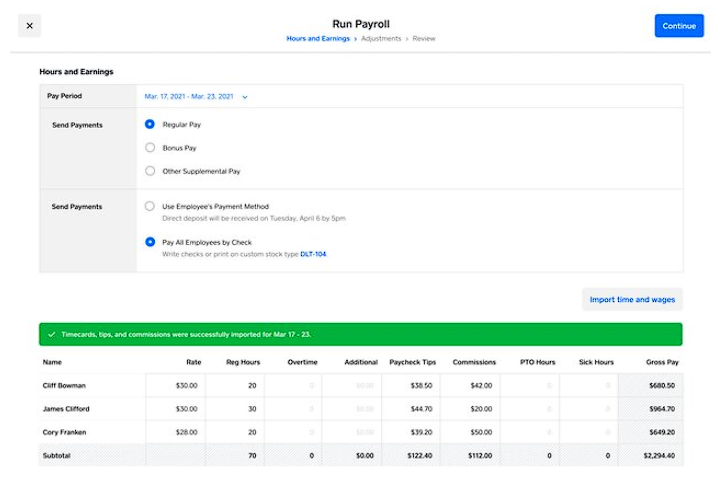

4. Quickbooks Online

Intuit QuickBooks provides support for small businesses’ HR and payroll systems. The software automates various payroll tasks such as calculating employee wages, withholding taxes, processing direct deposits, and preparing tax forms. Users can run payroll on an automated schedule, pay both W-2 employees and 1099 contractors, and manage employee benefits and HR services.

Features & Services:

- Tax Penalty Protection: Quickbooks will cover and pay up to 25,000 in penalties.

- Auto Payroll: Users can set up payroll to run automatically.

- Time Tracking: Users can approve time sheets and create invoices while on the go.

- 24/7 Support: Users can call anytime to get help or have their questions answered.

Pricing:

- SimpleStart: $30 per month

- Essentials: $60 per month

- Plus: $45 per month

- Advanced: $200 per month

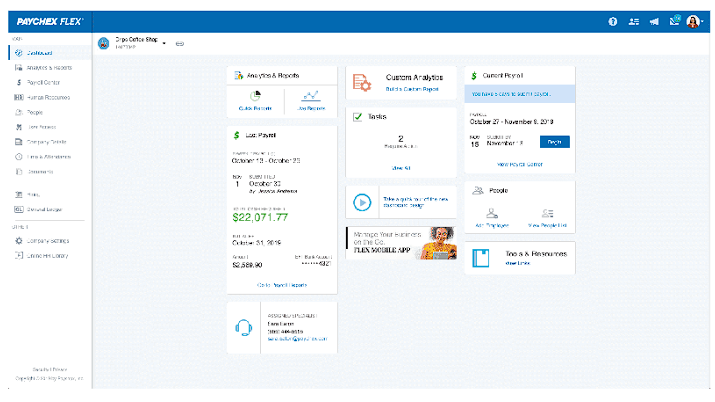

5. Paychex

Paychex offers services in payroll, human resources, and benefits management. This platform aims to streamline processes like employee payroll calculations, new hire integration, and managing benefits. Paychex also has tools to help support independent contractors and freelancers.

Features & Services:

- Time Clocks: Receive automated time tracking and reporting, hands-free payroll exports, wage compliance, cost management, etc.

- Self-Employed: Offers solo retirement plans, payroll and tax services, and round-the-clock support.

- Payroll Tax Services: Handles all payroll tax calculations, payments, and filing with the appropriate agencies.

Pricing: No pricing information is provided online.

6. Square Payroll

Square Payroll is a cloud-based payroll software for small to medium-sized businesses. This platform specializes in tax management, inventory, financial services, and more. Users can pay employees and contractors using this platform.

Features & Services:

- Tax and Compliance: Takes care of ongoing state and federal tax filing, including w-2 and 1099-NECs.

- Accounting: Automate bookkeeping by syncing users’ data to QuickBooks Online.

- HR Manager: Users can get certified advice from HR experts to build handbooks.

Pricing: $35 per month and $6 per contractor

7. Papaya Global

Papaya Global is a payroll solution designed for organizations that have international employees. This platform streamlines the managing, automating, and ensuring compliance for all global payroll operations. Papaya also offers data security and analytics.

Features & Services:

- Contractors: Manage, onboard, and pay talent across the globe from one place with liability.

- Employer of Record: Users can hire from over 160 countries around the world.

- Equity Management: Grants equity type for all employees in all locations.

- Immigration: Helps employees navigate immigration laws, visa requirements, and work permits worldwide.

Pricing: Papaya starts at $3 per employee, per month

- Full-service payroll: $12 per employee per month

- Payroll Platform License: $3 per employee, per month

- Data and Insights Platform License: $150 per location, per month

- Payment-as-a-Service: $3 per employee, per month

- Employer or Record: $650 per employee, per month

- Contract Management: $2 per contractor, per month

- Global Expertise Services: $190 per employee, per month

8. APS Payroll

APS Payroll is a payroll and workforce management software for businesses of all sizes. This platform has a range of services, from HR management to self-service portals. Users can access documents like pay stubs and tax forms using the portal offered by APS Payroll.

Features & Services:

- Payroll: Set gross wage limits, void payroll checks, import timekeeping data, and customize payroll processing.

- Workforce Planning: Users can address talent gaps, manage labor costs, and streamline onboarding for employees.

- Core HR: Eliminate paper and make the HR management online with automation.

- Attendance: Track time, schedule employee shifts, and control labor costs from one place.

Pricing: APS Payroll offers three plans: Payroll, Payroll and Attendance, and Payroll + HR+ Attendance. However, there isn’t any pricing information available online.

9. Deel

Deel is a worldwide payroll and compliance solution that helps companies with recruiting and overseeing remote teams across the globe. This platform provides resources to simplify payroll for international workers and independent contractors, so businesses can pay international employees in their local currencies.

Features & Services:

- EOR: Hires employees from over 100 countries, with or without entities.

- Contractors: Manages compliance and pays all international contractors.

- Deel HR: Automates HR admin and reporting for employees in the global HR system

- Global Payroll: Run payroll in over 100+ countries or wherever users have entities.

Pricing:

- Deel HR: Free for teams with up to 200 people

- Contractors: $49 per month

- EOR: $599 per month

- Global Payroll: Get a quote

- Immigration: Get a quote

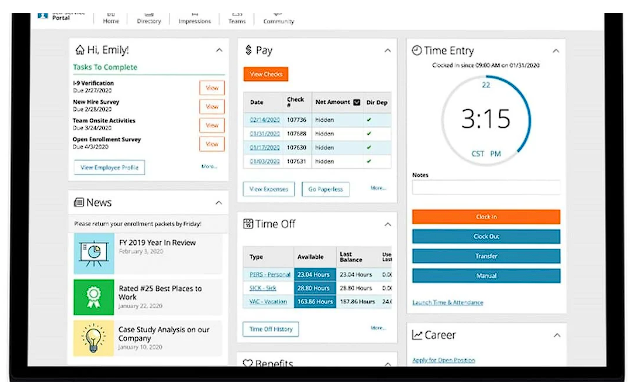

10. Paylocity

Paylocity is a cloud-based payroll and HCM software that streamlines various HR tasks. Some of the services Paylocity offers are benefit administration, talent management, attendance tracking, and analytics.

Features & Services:

- Hiring: Recruit new talent with job listings and custom videos, launch background checks, and reach out to candidates with text or email.

- HR Software: Users can access the self-service portal for benefits packages, training, payments, and more.

- Time and Attendance: Users can manage time off, apply shift differentials, and use points to track attendance automatically.

Pricing: No pricing information is provided online.

11. SurePayroll

SurePayroll is a payroll software that caters to small and medium enterprises. The service has services such as tax handling, reporting, setting up direct deposit, and more. In addition, SurePayroll also offers tools and services to support clients’ needs in benefits administration and HR management.

Features & Services:

- Payroll on the Go: Users can manage payroll from anywhere using the mobile app.

- Tax Filing: File federal, state, and local taxes and deposits, and stay current on changing laws.

- Reporting: View and download customizable reports, and user can integrate reporting into accounting software

- Direct Deposit Setup: Pay employees on time or cancel payroll to fix errors and have access to same-day and next-day payroll.

Pricing: SurePayroll starts at $4.99 per month

Use the Best Automated Payroll Software

With the right automated pay system or software, you can pay all contractors and employees on time without the hassle of calculating, reviewing documents, and creating invoices. You can also avoid any legal penalties and fees since automated payroll systems can accurately classify workers, provide insurance and coverage, and maintain tax documents for W-2s and 1099-NECs.

What’s the best automated payroll software for productions? LÜK!

LÜK provides a straightforward platform designed to make it simple for producers to track and manage their 1099 payroll. The platform can accurately classify work, extend workers’ compensation coverage, serve as the official employer on record, and easily send out 1099-NEC forms when tax season arrives.

Streamline the way you do payroll with LÜK!

![11+ Best Automated Payroll Systems & Software [2024]](https://blog.luknetwork.com/wp-content/uploads/2025/03/a589c-payroll-system.png?w=710)

![Wrapbook Review: Unwrapping this Entertainment Payroll Software [2024]](https://blog.luknetwork.com/wp-content/uploads/2025/03/0a1a4-production-payroll-3003099126-e1700663602573.png?w=721)