As the global entertainment industry continues to flourish and expand, the need for efficient and reliable entertainment payroll services has never been more important. According to Forbes, entertainment spending reached nearly $37 Billion in 2021. With productions growing in both scale and complexity, successful projects of all sizes demand the management expertise of seasoned payroll providers.

Between setting up casting auditions, approving creative materials, and staying within budget, producers have their work cut out for them. And payroll is a huge part of that. Why not make it simpler with an efficient, seamless, entertainment payroll service?

We at LÜK are dedicated to making producers’ lives better…so we’ve researched some of the top entertainment payroll providers specializing in various aspects of the entertainment world, including talent payments, pre-production, and international computations.

Discover the perfect fit for all your payroll requirements so your production can be easy, breezy, and stress-free.

Who handles payroll in productions?

In entertainment productions, the payroll management process requires a unique blend of expertise, industry knowledge, and attention to detail. Production companies often rely on professional accountants or specialized payroll service providers to ensure a seamless payment process across all parties involved.

Entrusting payroll to experts ensures adherence to industry standards and compliance regulations, facilitating the smooth functioning of project timelines. These professionals also manage call sheets, commercials, compliance, accounting, union requirements, and more, making it critical to partner with a top-notch payroll provider.

What’s included in entertainment payroll services?

Entertainment payroll services encompass an extensive range of responsibilities, addressing various aspects of production finance. These include:

- Accurate calculations of wages, premiums, tax deductions, and union contributions for talent, crew members, and entertainers

- Expert handling of complex payroll processes and regulations for both domestic and international productions

- Detailed tracking of performance and participation in creative projects

- Management of call sheets and other essential production documentation

- Compliance with industry standards and regulatory changes, as well as the negotiation and securing of relevant tax credits and incentives

- Providing customizable and personalized support tailored to the unique demands of each production, spanning from pre-production planning to post-production financials

With a comprehensive approach and specialized industry expertise, entertainment payroll service providers cater to the diverse needs of clients throughout the entertainment industry, ensuring a smooth and successful production experience.

By entrusting the right partner with your payroll needs, you can focus on the creative aspects of your project while knowing that the financial side is in expert hands.

✨📚 Also LÜK At

- Best Modeling Agencies in the US

- Top Modeling Agencies in NYC

- Best Casting Agencies in NYC

- Free Shot List Template

- Top Casting Agencies in Los Angeles

- Entertainment & Media Statistics to Know

Top Entertainment Payroll Services

With the unique demands and complexities of the entertainment sector, it’s crucial to choose a reliable and efficient payroll service provider. Now let’s dive in and explore your options!

1. LÜK Network

Best for: Photoshoot productions

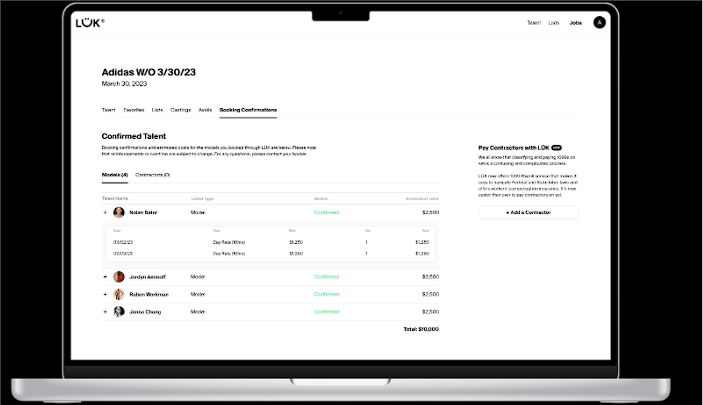

LÜK Network specializes in providing payroll solutions tailored to the entertainment industry’s unique needs. Our user-friendly platform allows for easy tracking and management of payroll for independent contractor cast and crew members. LÜK’s full-coverage solution correctly classifies freelancers, manages worker’s compensation and payroll taxes, and pays talent from multiple agencies with just one invoice.

Of course, we’re more than just an entertainment payroll service. Zooming all the way out, LÜK provides all the tools and services producers need to simplify their workload and free them up to focus fully on the creative needs of their shoot.

Services:

- Entertainment payroll processing

- Pre-populated invoices and automated approvals

- Compliance management

- Correct worker classification

- Transparent and fast payment via FlashPay

- Tax management

- Talent and crew booking tools

Choose LÜK Network for a tailored and efficient payroll experience in the entertainment industry–and much more.

2. Entertainment Partners Payroll Services

Best for: Large-scale film and television productions

Entertainment Partners (EP) is a provider of payroll services in the film industry, boasting an impressive track record of successful partnerships with top studios and productions. Their SmartStart and SmartTime solutions help streamline the onboarding and timekeeping processes, making payroll management a breeze. EP ensures compliance with labor laws and union rules, mitigating risks associated with complex entertainment payrolls.

With their extensive Scenechronize platform, you can manage budgets, schedules, and documents all in one place.

Services:

- SmartStart onboarding

- SmartTime timekeeping

- Budgeting and scheduling

- Customer support and assistance

3. Extreme Reach

Best for: Advertising productions

Extreme Reach offers an end-to-end payroll solution designed for the advertising and entertainment industries. Their cloud-based platform enables seamless management of talent and crew payments, ensuring timely and accurate disbursements. Extreme Reach’s platform also offers tax and union compliance features and flexibility to accommodate payroll projects of any size.

Services:

- Talent and crew payment processing

- Tax and union compliance features

- Scalable payroll operations

- Powerful reporting tools

- Dedicated support team

4. Media Services

Best for: TV, film, media, and commercial productions

Media Services offers an entertainment payroll solution, Showbiz Timecards, which provides a suite of tools for managing payroll, budgeting, and scheduling. In addition to payroll services, they provide production accounting, tax incentives, and software training for entertainment professionals.

Services:

- Showbiz Timecards payroll management

- Accounting software integrations

- Production accounting services

- Tax incentives and software training

5. Wrapbook

Best for: Independent creators in various entertainment sectors

Wrapbook is a modern payroll solution designed specifically for film, TV, and commercial productions. Their platform helps simplify the payroll process, from onboarding talent and crew to processing payments and generating reports.

The platform also offers a digital timecard feature, making it easy to track hours and approve timecards. With built-in financial tools, you can manage your production budget effectively and monitor expenses in real time. Wrapbook’s dedication to security ensures your sensitive financial data remains protected.

Services:

- Digital onboarding for talent and crew

- Digital timecard feature

- Built-in financial tools for budget management

- Secure and efficient payment processing

6. Willa Pay

Best for: YouTubers, actors, and influencers

Willa Pay is a payroll solution for freelancers and independent contractors in the entertainment industry. Their platform simplifies invoicing, payment tracking, and tax management for both talent and employers. With Willa Pay, you can process payments quickly and securely, to help improve cash flow and reduce administrative burdens.

The platform also provides a tax management system, ensuring compliance with tax regulations for independent workers. Willa Pay’s innovative approach to freelance payroll fosters collaboration and financial transparency between employers and talent in the entertainment industry.

Services:

- Freelancer and independent contractor payroll processing

- Invoicing and payment tracking

- Tax management system

- Quick and secure payment processing

- Dedicated customer support

7. Cast & Crew

Best for: Film and television productions

Cast & Crew provides entertainment payroll services, catering to the unique needs of film, television, and live event productions. Their PSL+ platform streamlines the payroll process, managing everything from timecards to tax filings. They also have reporting solutions that allow you to track expenses and analyze production financials.

In addition to payroll, Cast & Crew offers production accounting, tax credit consulting, and workers’ compensation services.

Services:

- PSL+ payroll platform

- Tax filings and compliance management

- Robust reporting tools

- Production accounting and tax credit consulting

8. ABS Payroll

Best for: Commercials, films, and TV productions

ABS Payroll is a reputable provider of payroll services, specializing in independent films, television, and commercial productions. ABS Payroll’s platform offers an accurate payroll process, including timecard management, tax filings, and direct deposits. They also offer additional services such as production accounting, tax incentives, and workers’ compensation.

Services:

- Independent film, TV, and commercial payroll services

- Timecard management and tax filings

- Customized reporting tools

- Production accounting and tax incentives

9. Greenslate

Best for: Film, TV, and commercial projects

Greenslate offers innovative and eco-friendly payroll solutions for film, television, and commercial productions. Their cloud-based platform streamlines the entire payroll process, from onboarding to payment disbursement and reporting. With a focus on sustainability, Greenslate eliminates paper waste by utilizing digital timecards, paystubs, and tax forms.

Services:

- Eco-friendly payroll management

- Digital timecards, paystubs, and tax forms

- Production accounting and tax credit consulting

- Software solutions for financial management

10. Top Sheet

Best for: Film, TV, and commercials

Top Sheet offers a user-friendly payroll solution designed specifically for the entertainment industry. Their platform streamlines the payroll process, handling timecards, payment processing, and tax filings.

Services:

- Streamlined payroll processing

- Advanced reporting tools

- Accounting software integrations

- Secure financial data protection

11. TEAM Companies

Best for: Music, TV, film, and commercial production

The TEAM Companies is a provider of payroll services for the entertainment industry, offering customized solutions to suit your production’s specific needs. With all-inclusive services such as payroll processing, tax filings, and reporting, TEAM Companies helps streamline your payroll operations. In addition to payroll services, TEAM Companies offers production accounting, tax credit consulting, and workers’ compensation solutions.

Services:

- Customized payroll solutions

- Tax filings and compliance management

- Production accounting and tax credit consulting

- Workers’ compensation services

12. NPI Entertainment Payroll

Best for: Theatrical, film, and live entertainment productions

NPI Entertainment Payroll is a provider of payroll services, focusing on film, television, and commercial productions. NPI’s platform streamlines the payroll process, managing timecards, tax filings, and direct deposits. NPI Entertainment Payroll also provides production accounting services and tax incentive consulting. With personalized customer support, NPI offers a seamless payroll experience for entertainment professionals.

Services:

- Specialized entertainment payroll services

- Timecard management and tax filings

- Powerful reporting tools

- Production accounting and tax incentive consulting

12. CAPS Payroll

Best for: Film, television, and live events

CAPS Payroll is an adaptable payroll solution provider, catering to film, television, live events, and commercial productions. Their platform handles everything from timecard management to tax filings and payment disbursements.

Services:

- Entertainment payroll services for film, TV, live events, and commercials

- Timecard management and tax filings

- Powerful reporting tools

- Accounting software integrations

Use the Best Entertainment Payroll for Your Shoot

Accurate and timely payroll management is essential for building trust with your cast and crew, as well as adhering to the complex labor laws and regulations in the entertainment industry. Each payroll company on this list offers specialized solutions tailored to the unique needs and requirements of different sectors within the entertainment world, ensuring that your specific payroll needs are met with precision and expertise.

By choosing the right payroll service, you can mitigate risks, ensure smooth operations, and ultimately focus on bringing your creative vision to life.

LÜK Network is the top entertainment payroll choice–in addition to offering a full suite of producer tools designed to streamline your casting and payment processes. With LÜK’s innovative and user-friendly platform, you can confidently manage your entertainment payroll while maintaining compliance with industry regulations.

Plus, with our suite of producer tools, we simplify the casting and booking process for clients by providing a single point of contact for accessing a diverse range of talent. We assign a personal booking specialist to each client, who handles all aspects from start to finish, including castings, availability checks, and digital/polaroid requests.

Don’t leave the success of your production to chance—ensure that you have the right payroll partner on your side.

![12+ Best Entertainment Payroll Services for a Successful Production [2024]](https://blog.luknetwork.com/wp-content/uploads/2025/03/715b1-entertainment-payroll.png?w=453)

![How Not Having Workers’ Comp for Your Production Can Get You Sued (Or Worse) [2024 Guide]](https://blog.luknetwork.com/wp-content/uploads/2025/03/18964-worker.png?w=412)